WRITTEN BY- LinguoTheGrammarRobot

All right boys and girls, given the recent war of words (and legal documents) between Melnyk and Ruddy, and the fact that Forbes recently completed their 2018 NHL franchise valuations, it makes sense to revisit my ChirpEd from last year on the financial state of the Ottawa Senators, updated for the new financial information.

As with last year – a few items before I begin:

-The information below is from sources that are publicly available, no hearsay.

-I will be more than happy to explain or elaborate on my methodology in the comments below if there are any questions. That being said – I will not respond to comments that are clearly innuendo or have no factual basis i.e. “You’re wrong – the team doesn’t lose money – Donald Trump tweeted as such.” OH, AND READ THE NOTES.

-This is a picture of the financial health of the Team – not Eugene’s overall financial health. We have no way of knowing how Eugene’s investments are doing, nor do we know if there are other revenues related to the building (concerts etc…) that are not reflected in the figures below, though I doubt it.

-All grammatical mistakes, methodological flaws etc… are due to the fact that I have a 5-week-old son and I’ve slept about 9 hours this week. I’ve never been wrong in my life and I ain’t starting now – so when in doubt – it’s my son’s fault.

-Some of you may have noted I copy pasted most of this from last year, don’t give me lip. I’m too tired to be witty.

Don’t know accounting? Confused about the difference between an income statement, balance sheet and cash flow statement? Need an accounting refresher? See my ChirpEd from last year:

http://senschirp.ca/chirped/chirped-financial-state-ottawa-senators/

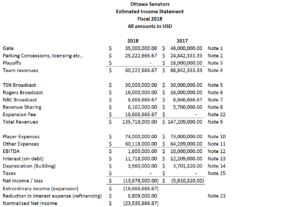

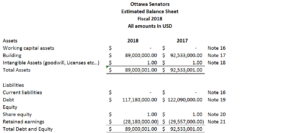

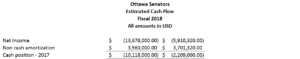

So, for those of you that have made it this far, here are the 2018 updated statements based on publicly available information (Editor’s Note- click on the images to expand):

Did you read all that? Even the notes? Don’t lie to yourself, I’ll be my usual sarcastic self in the comment section below if you ask something already answered in the notes above.

Additional disclaimer: Brian Crombie is now the “interim” Chief Financial Officer.

With that further disclaimer out of the way – Key 2018 Takeaways:

-Gate, the single biggest source of income for the team is down 24% from 2017. Ouch.

-No playoff money. Ouch.

-Gross Revenue is down 8% from the prior year. That isn’t so bad right? Wrong. Gross revenue includes the expansion fee for Vegas. If you exclude that, Gross revenues are down 19% from the previous year. Ouch.

-Player expenses stayed flat.

-Other expenses dropped by 6%. So there hasn’t been net investment in the team, just net cuts.

-Net income for 2018 – a $13M loss. That’s not so bad right? Well, remember that loss includes the Vegas expansion fee. So, ignoring the one time expansion fee, the loss is about $30.3M for 2018.

-What about cash? Cash is king right? Well the team appears to have racked up an additional $10M in cash losses in 2018.

Remember the refinancing press release? The one announcing the new $135M loan that replaced the Senators old debt? The team noted that those funds would be used to: “pursue growth, serve general corporate purposes and to replace existing debt.” Presumably those funds were allocated as follows:

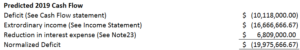

It would therefore appear that to start the year, the team had a cushion of $5.3M in new borrowing that they could use to fund operations. Why does that matter? Well, for one thing, the team had about $10M in cash losses last year. If they burn through cash at the same rate, they’d need another loan by Christmas 2018. However, if we want to be truly accurate when estimating the cash requirements for the team going forward, we would need to normalize the teams cash flow:

So, instead of lasting half a year to Christmas, that $5.8M in cash looks like it was only going to last to the end of October. Surprise, surprise, October 30, 2018 comes around and this press release happens:

So, the team was out of cash and was thrown a life preserver by BMO. With this new borrowing, and assuming the teams cash burn remains constant, they should have enough capital to cover operations until about March 2020. However according to this source attendance is down further this year and that will likely speed up the cash burn. Unless the team can get further loans, their finances look to be getting really, really shaky by about December 31, of next year unless they do something drastic.

What can the team do? Well, they’ve already cut non-hockey operations to the bone. The next place they’ll look for savings is player salary. Let’s assume that the team cuts player salaries by about $10M starting next year to get them close to the cap floor. Having burned though about $10M of the line this year, that leaves the team with $20M left over to fund future deficits (2020 and beyond). Assuming attendance remains constant (a generous assumption) the team would burn through those additional borrowed funds in about 2 years. Just long enough for them to get some tasty, tasty Seattle expansion money. In theory, with the current borrowing and expansion money from Seattle, the team can stay afloat for at least the next 4ish years, but that assumes attendance doesn’t deteriorate, team salary stays cut to the floor, and the floor remains constant.

What can we infer from all of this?

Well, first of all, the team is piling on loans. They’re pushing up to $165M in borrowing. Even though the interest paid on these loans is likely at a lower rate than what was paid in the past, as the balance of the loans continues to go up, so do those lower interest payments. The team obviously is hemorrhaging money as evidenced by the Forbes information and the teams increase in borrowing by nearly $50M (the net refinancing plus the BMO line). Melnyk is obviously unable, or unwilling to fund the team, again as evidenced by the increased borrowing. Sadly, the team appears to be racking up debt faster than the value of the team is appreciating in value. If this is true, by holding onto the team the owner may be eroding his future gains.

Would a downtown arena stabilize the teams finances? Maybe. Will that arena exist by the end of next year? No. Will it exist in two years? No. Will it exist in 4 years when the Seattle expansion money runs out? Likely not. Does the team have the financial resources to keep the team running until a new building is available? Could a new CBA save the team from financial ruin? Could a future lockout put the team into bankruptcy protection? Please speculate wildly below.

TLDR – Billionaire can maintain grip on team (to his possible financial detriment) for immediate future with the team becoming the Montreal Expos of hockey.

I wonder what Jeffrey Loria up to these days?

Merry Christmas from Linguo, Lingua, the Linglets (and SensLady, TCharger and Terry).

-Linguo