WRITTEN BY- LinguoTheGrammarRobot

Given Eugene Melnyk’s recent comments and the fact that Forbes just completed their 2017 NHL franchise valuations, I thought it made sense to compile what we know and what we can infer about the financial state of the team in one horribly long ChirpEd. A few items before we begin:

1. The information below is from sources that are publicly available, no hearsay. The figures included below are what we can extrapolate from that publicly available information. And using that publicly available information, we can try to get a closer look at the team’s financial position.

2. I will be more than happy to explain or elaborate on my methodology in the comments below if there are any questions. That being said – I will not respond to comments that are clearly innuendo or have no factual basis i.e. “You’re wrong – the team doesn’t lose money – my uncles neighbour heard that from his hairdresser who was chatting with Super Dave Osborne.” OH, AND READ THE NOTES.

3. This is a picture of the financial health of the Team – not Eugene’s overall financial health. We have no way of knowing how Eugene’s investments are doing, nor do we know if there are other revenues related to the building (concerts etc…) that are not reflected in the figures below, though I doubt it.

4. All grammatical mistakes, methodological flaws etc… are due to the fact that I just had dental surgery and I’m sailing along on a codeine and scotch fueled rainbow. I’ve never been wrong in my life and I ain’t starting now – so when in doubt – it’s the pills fault.

The analysis below is split into two parts:

-An estimated financial state of the team, and

-An estimate of what Eugene stands to gain by selling right now.

The Financial State of the Team

So let’s get crackalacking. I’m going to take the approach that an investment banker may take for estimating the financial state of the team. That’s the fancy way of saying I’m going to take the publicly available information and try to use that to generate a set of financial statements.

What are financial statements? They’re long, they cost a lot of money to get audited, and they look like Greek to most people. With that understanding, let’s sit down with Professor Linguo for Accounting 101. Generally, the most important chunks of financial statements consist of

-The income statement

-The balance sheet, and

-The cash flow statement.

The income statement generally shows how much money you made in any given year i.e. the income statement shows income aggregated for a 12 month fiscal period. What you really need to know is that an income statement is full of estimates and can be easily manipulated to show income or losses because it’s full of assumptions – rely on the income statement at your own risk. Don’t believe me? Ask anyone that invested in Nortel shares.

The balance sheet. The balance sheet is a point in time statement. It’s pretty straight forward i.e. at December 31, 2016 I had assets with an accounting value of XX, liabilities with an accounting value of YY and equity (i.e. shares and retained earnings) of ZZ. Always remember – a balance sheet generally shows historical cost – not fair market values of assets – So sometimes there are assets on a balance sheet that are actually worth a lot more than the amounts reported therein.

The cash flow statement. Like the income statement the cash flow statement is fiscal period statement (i.e. 12 month period statement). “Cash is king.” ALWAYS look at cash from operations. That is a number that you can generally use to understand if a business actually generates free cash flows (i.e. profit) or not. Think of the cash flow statement like your bank account. A properly generated cash flow statement should tell you your bank balance at the end of the year.

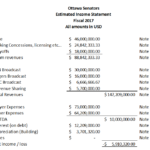

So, with that understanding let’s take a look at some of those financial statements I mentioned. Have questions about the numbers below – READ THE NOTES. They should answer most of your questions. Most of the figures themselves are from Forbes. If you don’t like those numbers – take it up with Forbes. (Click on each image below to expand)

Read all of that? Good. If you didn’t don’t worry – lets go through a “Coles Notes” version of what I think are important observations from them.

-The income statement shows about half the Senators income comes from broadcasting rights and revenue sharing. The other half comes from gate and the building.

-Player salary makes up about 55% of the teams expenses.

-The team’s margins aren’t great. On revenues of about $147M USD they end up with earnings before income tax, depreciation and amortization of about $10M USD.

-Interest payments are killing the team’s ability to turn a profit – add to those expenses the depreciation on the building (an expense related to the value of the building being used up) and the team had losses of about $5.5M USD for 2017 in a year where they earned about $18M USD in playoff gate. If they don’t go deep this year – The team’s finances look fugly from an income perspective.

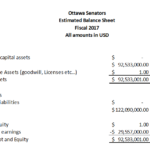

-The Senators have a pretty small balance sheet for an organization with a fair market value of $420M. That makes sense though because remember – Eugene bought the team cheap out of bankruptcy and the balance sheet reports historical costs

-Retained earnings is in a deficit position. Retained earnings is a summary of the net income or losses to date. Contrary to Eugene’s “I’ve lost $10M CAD per year for 10 years” shtick it appears, from a net income perspective, the team has racked up about $30M USD of actual losses (about $2.15M USD per year). That’s an average figure though, and I think we have every reason to believe that the teams finances have been worse in recent years and better further back

-Last year, as good as it was, still meant that cash went out the door to the tune of about $2.2M USD. While that seems ok, if the team didn’t make the playoffs – that’s closer to a $20.2M USD hemorrhaging of cash. No wonder Eugene looks so grey today – if the team doesn’t make the playoffs this year he may need to cut payroll by TENS of millions of dollars OR find someone to lend him more money. Hence – Eugene stomping the pavement looking for a bank to lend him money.

So, long story short – the numbers back up what we’ve been seeing reported in the media – the team is running out of cash – the playoff revenue last year just granted Eugene a reprieve. I think this is why we keep hearing his sale of the team is inevitable – no one appears to want to lend him money to fund his operational problems and he can’t cut payroll by tens of millions of dollars without devaluing the team.

Why can’t he get another loan you ask? Well, he’s already financed his current debt through a US based non-traditional lender. It’s reasonable to infer from this that the team is perceived as a very high risk creditor. In the current business climate I think it unlikely that a bank steps up to the plate and lends the team more money – especially given the team’s bad financial outlook.

What do you mean bad financial outlook? Well – it’s not like the team has much opportunity to grow its revenues by that much. The biggest of the TV deals that make up about half of the team’s revenue don’t expire until 2021 and 2025 so no luck there. In addition, the team just had its best gate in years (up $18M USD due to playoff revenue). It’s unlikely that they will repeat that anytime soon. So, yea – would you lend more money to that business?

So is all doom and gloom for Eugene? Find out next!!!

What Eugene Stands to Gain

Still awake? Good. Big picture, should Eugene feel grumpy today? I for one don’t think so. Let’s go through how Eugene can make it rain money in a very short amount of time.

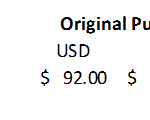

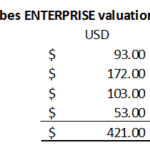

Let’s start at the beginning – remember when the team went broke the first time? We’ll a white knight named Eugene stepped in to save the franchise. Got a helluva good deal as well: (Click on image to expand)

So, all in, the team cost Eugene somewhere in the area of $92M USD to purchase. Vegas’ expansion fee was more than 4x that amount so – you probably know where this is headed.

So we know what the team cost. What’s it worth? Well you can calculate the team’s value in a few different ways. You can calculate the team’s enterprise value and you can calculate the team’s equity value.

Enterprise value is really just the value of the business’ assets ignoring everything else. Think of it like the value of your home – the market value of your home is a similar concept to enterprise value.

Equity value on the other hand is the value of the shares of a company that takes into account not only the assets – but the liabilities that come along with it. Confused? Don’t be. Think about your home. Let’s say you want to transfer your $100 house to your uncle with him assuming the $50 mortgage associated with the house. What’s your uncle ultimately going to pay you for that home? 50$ – the equity you’ve built up in it.

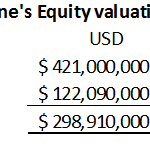

Forbes has calculated the enterprise value of the team as follows: (Click on image to expand)

So yea – that isn’t half bad – the team’s assets are worth $421M USD. What if someone wanted to buy the team though – what would they pay for the shares of the corporation that owns the team? That’s the equity value mentioned above and we can estimate that as follows: (Click on image to expand)

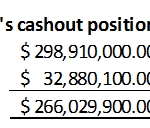

Looks like life isn’t half as bad as Eugene really wants to make it out to be. Even with all the operational losses his shares of the team have a $300M USD capital gain embedded in them. As you may know – capital gains are taxable at preferred rates in Canada and I know a little fancy footwork that can get the tax on a sale of this nature, very, very low. So assuming Eugene has good tax advisors he can expect after tax proceeds on a sale to be as follows: (Click on image to expand)

I’m not going to cry too much over his potential $266M payday. Yea yea, with legal fees and such it will be lower – but the pills are wearing off and my jaw is starting to ache so I’m not going to adjust for those.

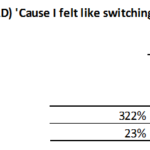

Long story short for those that got bored (again) – Eugene’s return on his investment in the team – even after all his operational losses (I weep for him) will be somewhere in the area of 322% (i.e. 23% per year). Yea, you shouldn’t feel bad for him either. (Click on image to expand)

So there you have it. Angry billionaire is upset that he may be forced to sell an investment that has returned 23% per year. Do with that conclusion what you will.

Thanks for reading!